About us

Change the way but

life Insurance

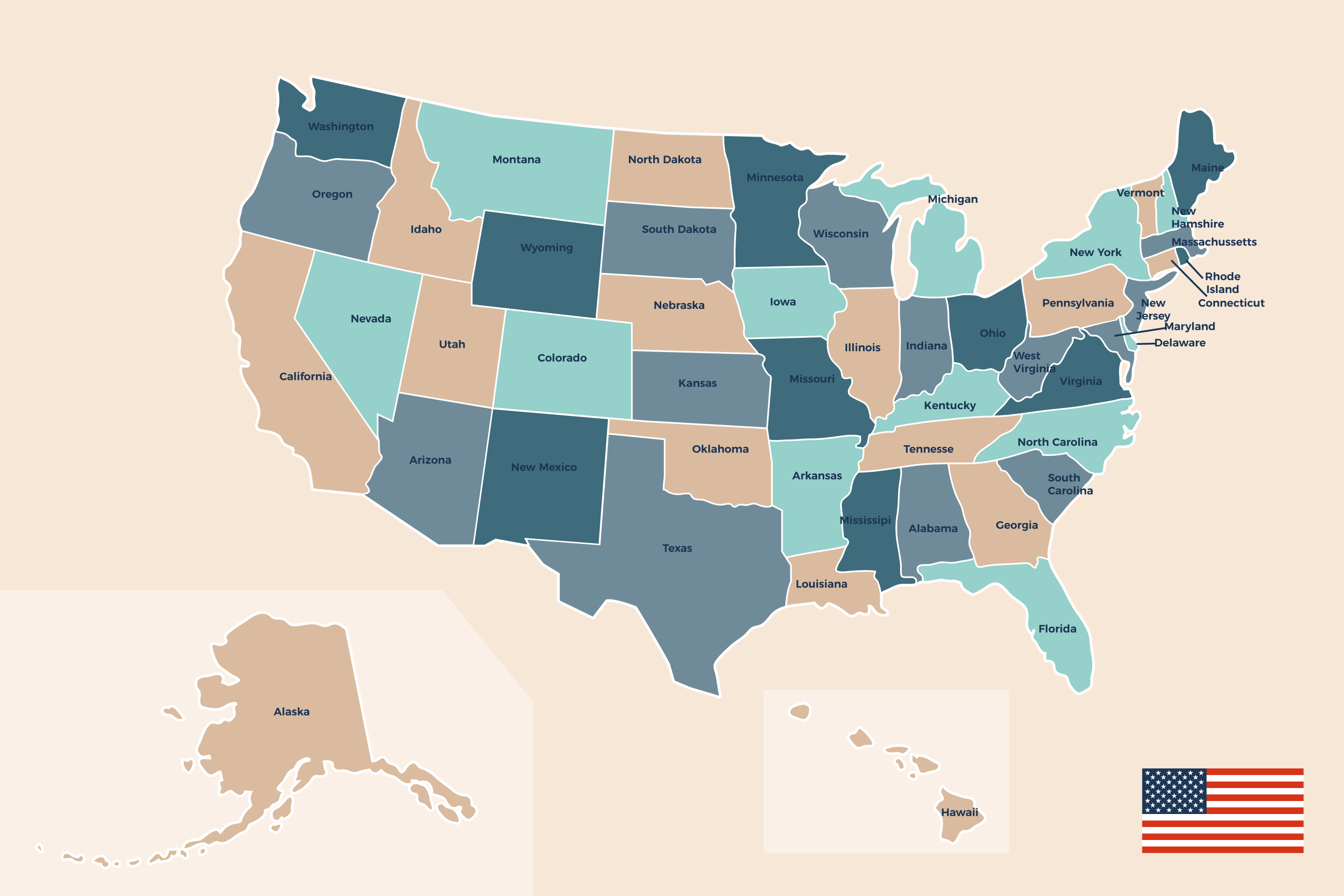

We are reputed licensed insurance agents. We carry out businesses in 14+ states and growing along USA. Below are some of our specialties:

What is life insurance?

- Enrol with a Tax-ID, or Social Security, or even with the National Identity from your home country.

- Affordable & Customizable 91% of claims paid within 14 days

- Insured Children as little as 18 days old and up to 89 years old.

- Bilingual Representatives (Spanish & English)

- We have a wide portfolio of companies to choose the best product that adjust your needs and your budget.

- No need of medical exams on eligible products and clients.

- We can do all the process online or in person.

- All our carriers offer the most of living benefits. You don’t have to die to enjoy the goods of your policy. If you get a terminal, chronic or critical illness, you can use the insured amount.

We are partnered with Ethos. Click the button below to buy the insurance now

Connect to Ethos

Our Partners

Policy Careers

Our Services

Types of insurance

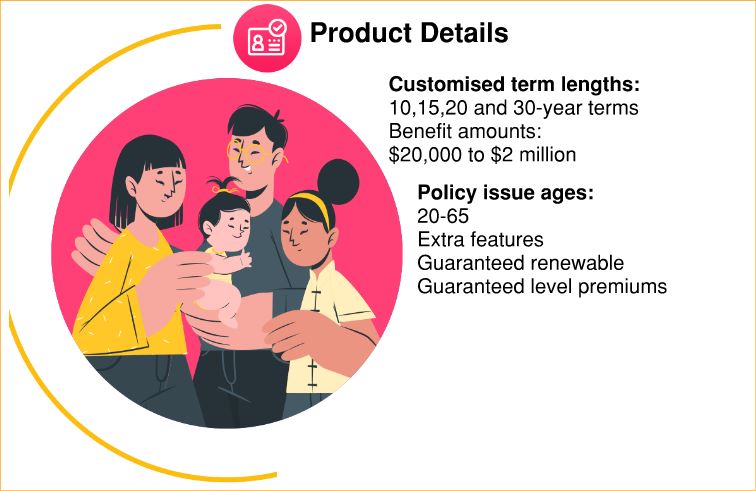

Term life insurance

You can choose the best life insurance policy for you by choosing from policies with different coverage amounts and terms. Every term life insurance policy we sell has fixed monthly premiums that don't go up as the policy goes on. The type of product, the amount of benefit, and who can buy it may vary by carrier.

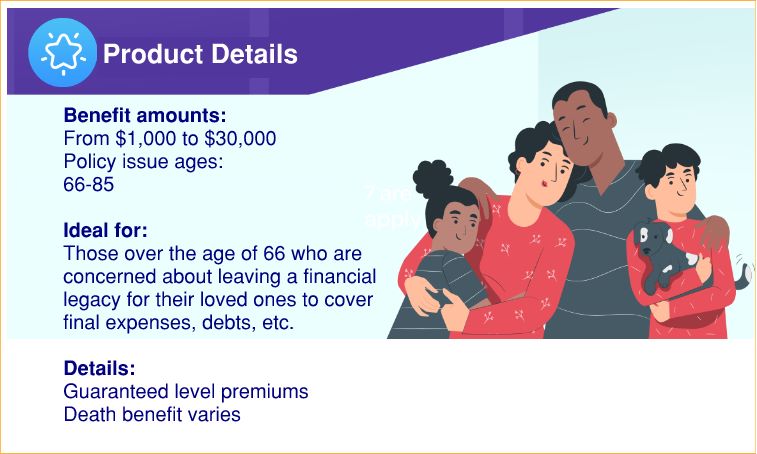

Whole Life Insurance

Many people have trouble getting approved for life insurance due to age or health-related issues. Your loved ones will be able to afford final expenses, debt payments, and living expenses. Thanks to the protection provided by our whole life insurance policy. If you're between the ages of 66 and 85, you can get instant approval with no need for a medical exam. Easy just answer some questions about your health. You're protected for life at a fixed rate that won't go up.

Universal Life Insurance

Index universal life is a form of permanent life insurance. Indexed universal life (IUL) insurance lets you decide how much cash value to assign to either a fixed account or an equity-indexed account. IUL insurance policies offer a number of well-known indexes, such as the S&P 500 or the Nasdaq-100. IUL insurance policies offer the possibility of cash accumulation while still providing a death benefit with all the living benefits that each company offers. IRS Section 7702 of the Tax Code differentiates income from a genuine insurance product.

Final Expense Insurance

Final expense insurance is a small whole life insurance policy that is easy to qualify for. The beneficiaries of a final expense life insurance policy can use the policy’s payout to pay for a funeral service, casket or cremation, medical bills, nursing home bills, an obituary, flowers, and more. However, the death benefit can be used for any purpose whatsoever. The death benefit is usually somewhere between $2,000 and $35,000.

Mortgage protection Insurance

as mortgage protection insurance is one that serves as a financial safeguard for your loved ones and helps ensure that your mortgage is covered in the event of your passing. With mortgage protection insurance, you can designate beneficiaries who would receive a payout, upon your death. This payout can then be used to pay off the remaining mortgage balance, allowing your family to maintain their home and avoid the burden of mortgage payments during a difficult time. By providing this protection, life insurance can offer peace of mind and help secure your family's financial stability, even in your absence.

Executive Bonus Plan

An executive bonus plan utilizing life insurance offers a dual purpose of providing valuable life insurance coverage for the executive with potential cash value accumulation and acting as an attractive compensation tool with a tax efficient method for the company